Socio-Economic Modelling

Socio-economic modelling analyzes the interaction between economic activity and social factors using statistical, mathematical, and computational tools. It assesses policy impacts, forecasts development trends, and evaluates resource distribution. This approach supports evidence-based planning, helping stakeholders understand implications of decisions on employment, income, health, education, and community well-being.

Socio-economic modelling for companies involves creating structured, often quantitative frameworks to simulate and analyze the interactions between social factors and economic activities relevant to business operations. Its primary purpose is to forecast outcomes, inform strategy, assess risks, and design interventions that benefit both business and society.

Core Principles and Components of Socio Economic Modelling:

Socio-economic modelling simplifies the complex relationship between societal structures (such as communities, demographics, or cultural dynamics) and economic factors (like employment, income, production, or consumption). Key elements include:

- Variables: Measurable factors such as population, local income, or educational attainment.

- Parameters: Fixed or exogenous values (tax rates, program costs, etc.) that shape how variables interact.

- Equations: Mathematical links connecting variables and parameters, showing causal or correlative relationships.

- Assumptions: Simplifications to make modelling feasible, acknowledging inherent limitations and uncertainty.

For example, a company considering a new community investment might model variables such as job creation, changes in household spending, and local business growth.

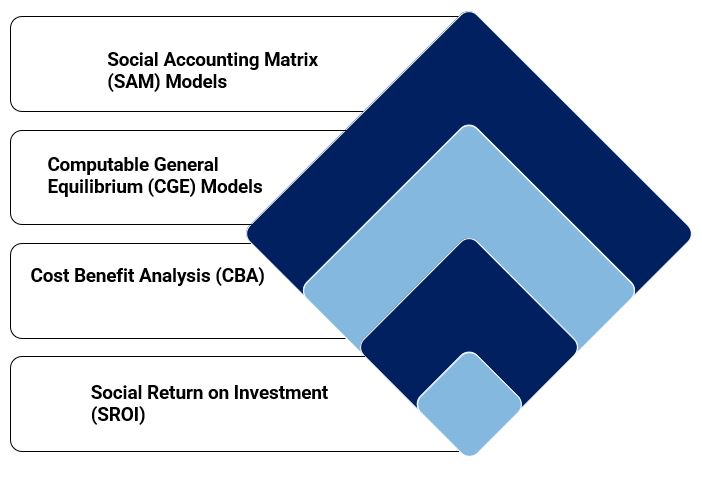

Modelling Approaches and Tools -Socio-economic modelling

Companies use a range of techniques to capture these complex interactions:

- Social Accounting Matrix (SAM) Models: Track flows of funds and value between different agents (households, businesses, government), helping to see where money circulates in an economy.

- Computable General Equilibrium (CGE) Models: Simulate how shocks (like new policies or investments) ripple through economies, changing employment, prices, or production.

- Cost Benefit Analysis (CBA): Quantifies all relevant costs and benefits (financial, social, environmental) of a project to evaluate its net impact.

- Social Return on Investment (SROI): Assigns monetary equivalent values to social and environmental outcomes, allowing companies to compare expected returns to initial investment—valuable when effects span beyond direct revenue.

Companies may also employ advanced econometric models (socio-econometrics) to predict long-term impacts, or tailor models to analyze sector-specific challenges, from resource planning to climate risk.

Applications in Companies – Socio Economic Modelling

- Impact Assessment: Before launching a new initiative, companies use socio-economic models to forecast expected contributions to employment, tax revenues, environmental effects, and community well-being.

- Strategy and Policy Evaluation: Modelling aids in scenario planning.

- Stakeholder and Community Engagement: By showing tangible community or societal benefits, companies strengthen relationships, manage reputational risk, and more persuasively communicate with shareholders, local governments, or NGOs.

- Sustainability and ESG Reporting: Models generate credible data for Environmental, Social, and Governance (ESG) disclosures, supporting transparency and compliance.

- Mitigating Social Risks: Early identification of potential negative impacts (such as displacement, inequality, or environmental harm) helps develop strategies to avoid, minimize, or offset these risks—critical for gaining regulatory approval and community acceptance.

Challenges and Best Practices in Socio Economic Modelling

- Effective socio-economic modelling requires:

- High-quality, relevant data—misleading or incomplete data can yield unreliable results5.

- Transparency about assumptions, data sources, and model structure—critical for credibility and stakeholder trust.

- Sensitivity analysis—to understand how outcomes shift with different assumptions or unexpected changes.

- Interdisciplinary expertise—combining knowledge of economics, sociology, environmental science, and local context for holistic assessments.

Conclusion

For companies, socio-economic modelling serves as a decision-support tool that provides evidence-based insight into how their operations will affect both the business and its broader human and environmental context. Done well, it supports sustainable growth, risk management, and the ability to demonstrate real value to society—outcomes that increasingly define long-term corporate success.

Company

Newsletter

We have a dedicated team of specialists for you as your email.