Investor Pitch Preparation

We provide investor pitch preparation by crafting compelling, data-driven presentations that clearly communicate a company’s value proposition, business model, market opportunity, and financial potential. Our support includes content development, design, and strategic storytelling to help clients engage investors effectively and secure funding with confidence and clarity.

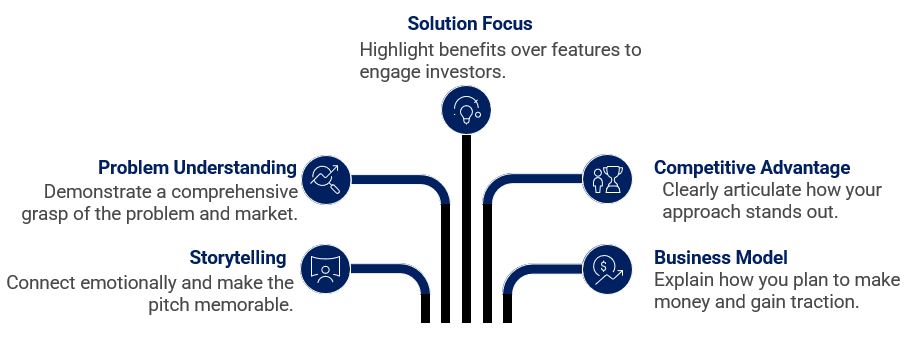

Investor pitch preparation is a process founders undertake to craft and deliver a compelling narrative that convinces potential investors of a business’s promise. It’s as much about storytelling and persuasion as it is about numbers and business acumen. Effective pitch preparation involves distilling the essence of your company into a presentation that is clear, concise, and memorable, while also anticipating and responding to the unique mindset of investors.

Start your preparation by identifying your core message. This includes a clear, succinct summary of what your business does, the problem it solves, and why it is uniquely positioned to win. The elevator pitch—often delivered in the first moments—is your hook. It should quickly captivate your audience, highlight the urgency or scale of the problem, and showcase what sets your solution apart. Avoid generic openings and instead open with a startling statistic, compelling anecdote, or a bold vision to gain attention early.

Construct your narrative with storytelling in mind. Investors are inundated with data but retain stories. Share the inspiration that sparked your venture, describe the pain points your target customers face, and outline how your product or service alleviates those challenges. Use real-world examples or testimonials for relatability. Storytelling helps you connect emotionally, allowing your pitch to be more memorable and impactful.

Demonstrate a comprehensive understanding of the problem and the market environment. Explain not only what the problem is but why it matters, who it affects, and the magnitude of the market opportunity. Show evidence that you’ve researched your target market: size, growth trends, and customer personas. Presenting this information succinctly communicates both your preparedness and the scale of the opportunity.

Clearly articulate your solution, focusing on benefits over features. Avoid technical jargon unless your audience is highly specialized. Demonstrate your product or service, if possible, and be transparent about its current state of development. If there’s a demo, practice rigorously to ensure flawless execution. Lay out your competitive advantage honestly—acknowledge other players and demonstrate how your approach is different or better.

Your business model is at the heart of an investor’s decision. Be explicit about how you plan to make money, your pricing strategy, and your route to market. Pre-revenue companies should still show indicators of traction: early user signups, strategic partnerships, letters of intent, media coverage, or industry awards can all help substantiate your momentum and credibility. This demonstrates that yours is not just an idea but a plan taking its first steps in the real world.

The team slide is critical. Investors back people as much as they back ideas. Highlight the unique skills and domain expertise your team brings and why you are especially positioned to execute this vision. Brief, relevant bios work best; excessive detail can dilute the impact.

Define what you’re asking for. Be precise about how much capital you seek, how the funds will be allocated, and what milestones you expect to reach with this funding round. An investor wants to see a clear path from investment to value creation.

Prepare for investor questions and scrutiny. Experienced investors will challenge your assumptions about market size, customer acquisition, competition, and scalability. Anticipate likely questions—about your competitive edge, go-to-market plan, unit economics, or major risks—and rehearse concise, confident answers. Practice with mentors or experienced entrepreneurs can help refine your delivery and strengthen weak points.

Polish is key. Your presentation materials—especially your pitch deck—should be sleek, free of clutter, and easy to follow. Visuals and data must support your story but not overwhelm it. Simplicity and clarity in design suggest professionalism and help investors focus on your message.

Finally, avoid common mistakes: don’t overpromise, ignore competitors, or get lost in technical detail. Don’t try to memorize the pitch word for word; instead, internalize your talking points so you can speak naturally and adjust based on investor reactions. Authenticity and passion, combined with careful preparation and solid facts, are what ultimately inspire investor confidence.

In sum, investor pitch preparation is about combining strategy, storytelling, and rehearsal. You must distill the complexity of your business into a presentation that excites, informs, and inspires action—all while demonstrating that you are ready to execute the plan you are describing.

Company

Newsletter

We have a dedicated team of specialists for you as your email.