Investment Support

Investment support encompasses strategic guidance across fundraising, portfolio management, risk assessment, and valuation analysis. Services include preparing investment decks, identifying potential investors, analyzing market entry opportunities, and supporting negotiations. This enables clients to navigate complex financial landscapes, strengthen capital strategies, and align investments with long-term business goals.

Investment support is a comprehensive framework of financial, strategic, and operational assistance designed to help entrepreneurs and startups move from concept to sustainable business. In an environment where access to capital and expertise can determine the pace and direction of innovation, effective investment support becomes crucial for converting promising ideas into market-ready solutions.

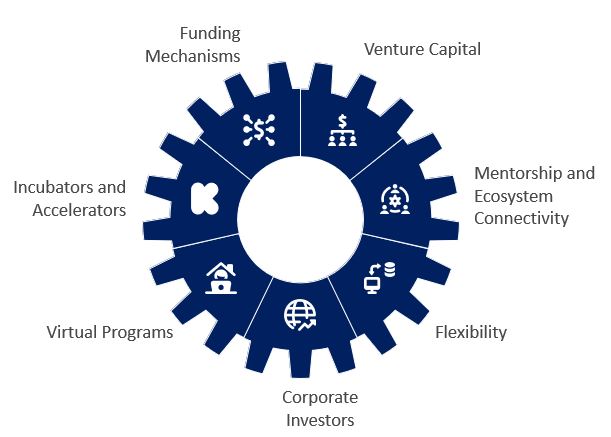

At its core, investment support begins with funding mechanisms that address the different stages of a startup’s lifecycle. Startups often need capital at their earliest phases—before revenues, customers, or even a finalized product exist. Specialized government schemes, such as the Startup India Seed Fund Scheme, aim to fill this critical gap by providing financial assistance for activities like proof of concept, prototyping, product trials, market entry, and commercialization. Grant-based support at this stage dramatically increases a startup’s chances of progressing to points where they can attract angel, venture, or institutional investments.

Venture capital and fund-of-funds initiatives further extend the reach of investment support. By channeling public or institutional money into venture funds, these frameworks indirectly finance a vast array of startups. Rather than direct investment, such structures empower fund managers who, in turn, select and nurture startups, leveraging both financial discipline and sectoral expertise. For example, agencies manage large corpus funds that are distributed to various alternative investment funds (AIFs), which then multiply the impact by investing in early-stage ventures across industries.

Incubators and accelerators offer another dimension of investment support, providing not just funding, but also infrastructure, mentorship, and access to networks. These organizations often act as the first investors—sometimes through equity, debt, or grant instruments—and focus on helping startups refine prototypes, test market fit, or even go to market. Many deep technology and research-driven ventures benefit from tailored programs that combine access to laboratory facilities, technical guidance, and business mentorship. Such holistic support ensures startups are not just capitalized, but are also equipped with the know-how and strategic relationships needed for scale.

A distinctive feature of modern investment support is its focus on mentorship and ecosystem connectivity. Beyond money, startups benefit by being introduced to domain experts, seasoned entrepreneurs, potential clients, and strategic partners. Matchmaking platforms and mentorship programs facilitate these interactions at scale, helping young companies avoid common pitfalls and accelerate their learning cycles. This kind of engagement cultivates a feedback-rich environment where strategic direction can be quickly refined and mistakes are treated as opportunities for rapid iteration.

The scope of investment support services can also include virtual programs, thereby removing geographical barriers. National programs may be designed to be sector-agnostic, allowing startups from diverse fields—be it health, education, climate, or fintech—to access resources and step onto a larger stage. These virtual platforms democratize access by connecting founders not only with capital but also with a global pool of mentors, investors, and customers.

Importantly, many modern investment support frameworks are designed with flexibility. Eligible startups can apply for support at various stages, and the type or amount of funding is tailored to specific needs—ranging from validation of ideas to commercialization and expansion activities. For some, the backing may come as equity-free grants, while others may benefit from convertible instruments or traditional equity investments. This flexibility ensures that startups receive the most appropriate type of support for their stage and sector, without excessive dilution or financial risk.

Increasingly, corporate investors and international development finance institutions are playing an instrumental role in this ecosystem. Their involvement often catalyzes global best practices, promotes rigorous governance, and opens up access to new markets. Programs founded by multinational technology companies offer non-dilutive funds, hands-on mentorship, and opportunities to tap into advanced product development resources.

Investment support, when coordinated across policy, private investors, and ecosystem builders, has broad ripple effects. Besides helping individual companies, it fosters job creation, stimulates sectoral innovation, and strengthens the entrepreneurial ecosystem as a whole. With robust investment support, entrepreneurial activity becomes more inclusive, resilient, and rapid—pushing economies toward more sustainable and competitive growth.

Company

Newsletter

We have a dedicated team of specialists for you as your email.