Crypto Currency Market

The market for cryptocurrencies is a cutting-edge financial ecosystem based on blockchain-powered decentralized digital currencies. Cryptocurrencies, in contrast to conventional fiat currencies, operate independently of a centralized authority and rely on cryptographic algorithms to safeguard transactions and generate new units. From a specialized idea to a worldwide phenomenon, this market now affects economies, industries, and individual investors. This blog examines the main forces, limitations, and difficulties influencing the cryptocurrency market’s course as well as its historical foundations, present dynamics, and potential future.

Crypto Currency Market in Early Stages:

An anonymous person or group known as Satoshi Nakamoto published a whitepaper introducing Bitcoin, the first decentralized digital currency, which is where the cryptocurrency market got its start. This was the start of a paradigm change in the way that value could be held and exchanged. By using blockchain technology to guarantee transparency, security, and immutability without the need for middlemen like banks, Bitcoin popularized the idea of a peer-to-peer electronic cash system.

The cryptocurrency market was a speculative frontier in its early years, drawing early adopters, libertarians, and computer enthusiasts. The cryptocurrency market’s early years were characterized by skepticism and volatility. Although widespread adoption was sluggish, Bitcoin and a few early altcoins, like Litecoin, gained popularity among specialized circles. Significant obstacles faced by the market were low knowledge, complicated technical issues, and security worries. The market’s credibility was damaged by well-publicized events like early exchange hacks and fraud involving phony initial coin offers (ICOs).

Crypto Currency Market at Present Stage:

The market for cryptocurrencies has advanced significantly since its inception. From digital currency to tokenized assets, the ecosystem has grown to encompass dozens of cryptocurrencies, each with unique functions. Significant institutional adoption has also occurred in the industry, with governments, businesses, and even big financial institutions investigating or implementing blockchain-based solutions. Exchanges now provide a variety of services, such as spot trading, derivatives, and staking, and are regulated platforms with cutting-edge security features. The market has changed even further with the emergence of decentralized finance (DeFi) systems, which allow users to trade, lend, and borrow without middlemen. Additionally, non-fungible tokens (NFTs) have become more well-known, opening up new markets for digital art, games, and collectibles. While tokenization makes it possible for fractional ownership of assets like real estate and intellectual property, decentralized autonomous organizations (DAOs) have become a cutting-edge method of coordinating group decision-making.

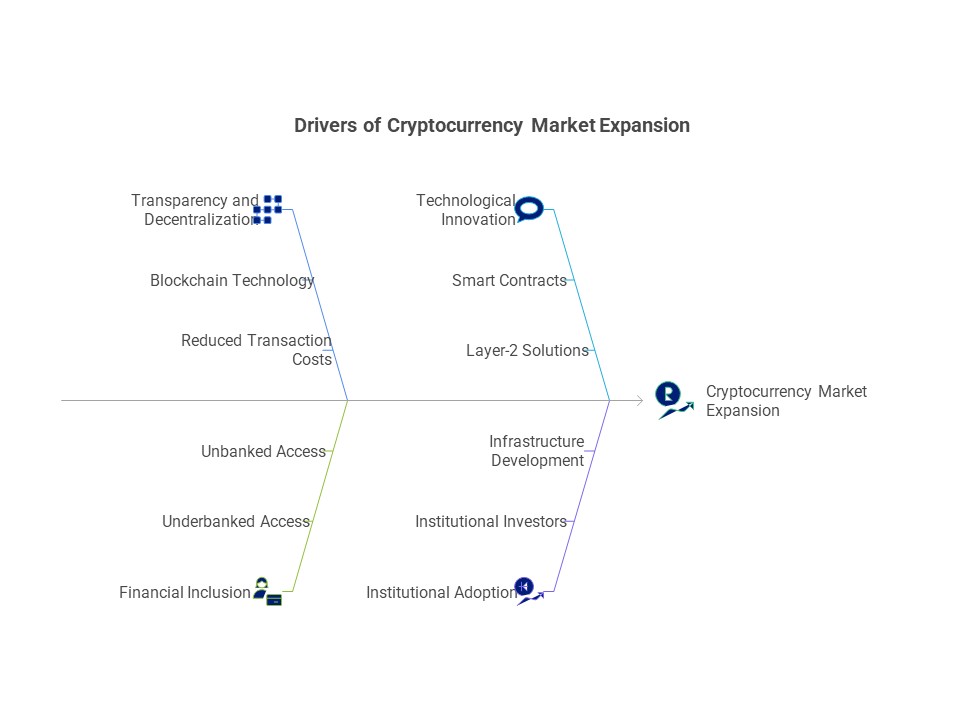

Drivers of the Cryptocurrency Market:

Transparency and Decentralization

One of the main factors propelling market expansion is the decentralized character of cryptocurrencies, which is made possible by blockchain technology. Cryptocurrencies improve efficiency and lower transaction costs by doing away with middlemen.

Inclusion of Finances

People who are underbanked or unbanked may be able to access financial services using cryptocurrencies.

Innovation in Technology

The application cases for cryptocurrencies are increased by ongoing developments in blockchain technology, such as smart contracts, layer-2 solutions, and cross-chain bridges. Developers, companies, and investors are drawn to these advances, which promote market expansion and diversification.

Adoption by Institutions

The cryptocurrency market has gained legitimacy with the arrival of institutional investors, such as businesses, asset managers, and hedge funds. Their participation promotes additional investment and infrastructure development by bringing cash, stability, and confidence.

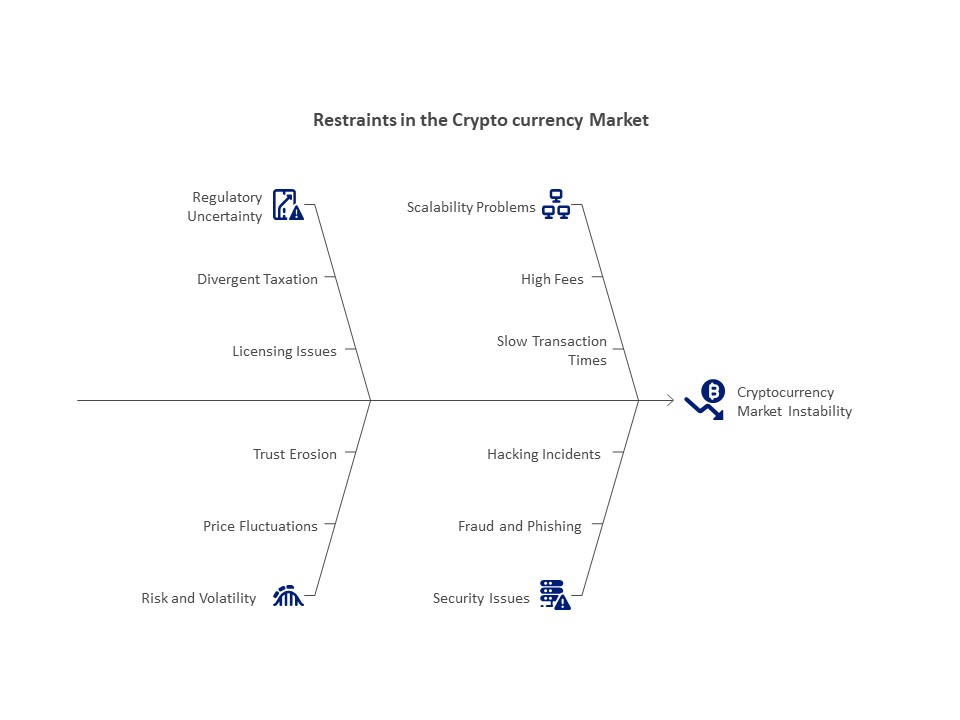

Restraints of the Cryptocurrency Market:

Uncertainty in Regulation

For market participants, the absence of uniform international regulations breeds uncertainty. Divergent taxation, licensing, and compliance strategies make corporate operations more difficult and turn off some investors.

Risk and Volatility

The volatility of the cryptocurrency market puts investors at risk and makes it difficult to use as a reliable medium of exchange. Unexpected pricing changes have the potential to undermine trust and restrict adoption for routine transactions.

Problems with Scalability

Due to scalability issues, many blockchain networks have high fees and sluggish transaction times during periods of strong demand.

Security Issues

The bitcoin sector is still susceptible to frauds, phishing attempts, and hacking despite security improvements. Prominent events erode confidence and emphasize the necessity of strong security protocols.

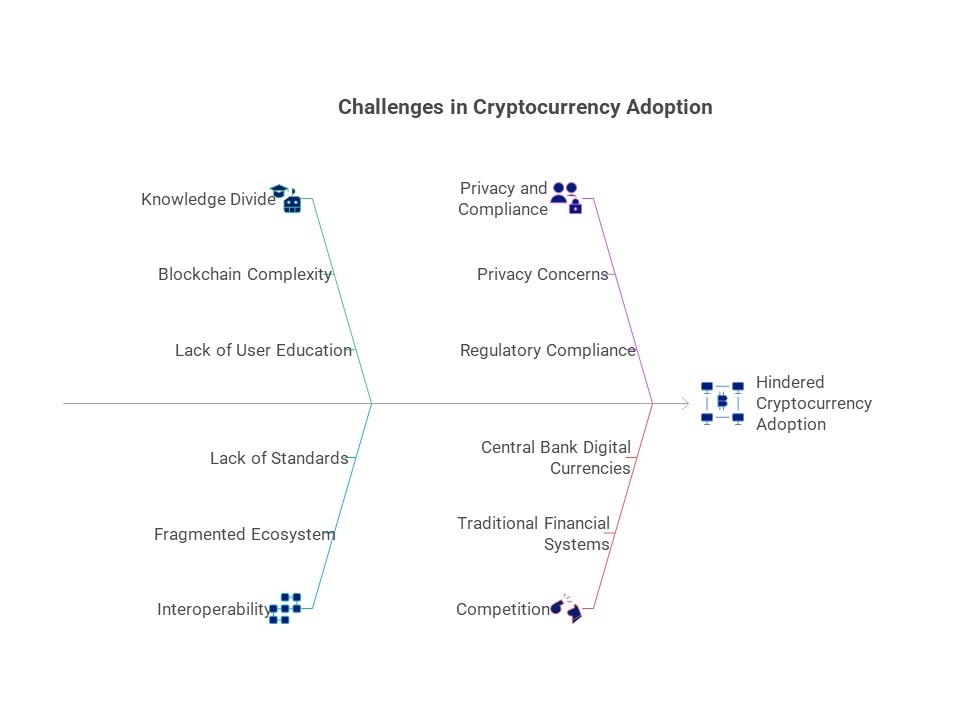

Challenges Facing the Cryptocurrency Market:

Closing the Knowledge Divide

Adoption may be hampered by the intricacy of blockchain technology and cryptocurrencies. To gain widespread acceptance, users must be educated about decentralized systems, wallets, and private keys.

Interoperability

The ecosystem is now fractured as a result of the growth of blockchain networks. To allow for smooth interactions across various platforms, cross-chain interoperability standards must be developed.

Privacy and Compliance in Balance

Cryptocurrencies have to strike a balance between user privacy and legal obligations. One of the biggest challenges is making sure that know-your-customer and anti-money laundering laws are followed without sacrificing the decentralized culture.

Traditional Systems’ Competition

Cryptocurrencies battle with established financial institutions and new CBDCs for market share. It is necessary to provide definite benefits in order to persuade users and companies to choose decentralized solutions over traditional systems.

From its early experimental stages, the cryptocurrency market has developed into a thriving, diverse ecosystem. A combination of creativity, opportunity, and challenges may be seen in its journey. It established the groundwork for decentralized finance in the past, is currently gaining traction through institutional adoption and a variety of use cases, and has the potential to revolutionize social and economic structures in the future.

Decentralization, financial inclusion, and technical developments are propelling the market’s expansion, but it is also constrained by factors including volatility, scalability concerns, and regulatory uncertainty. To realize its full potential, issues including public perception, education, and interoperability must be resolved.